(You might need to do this, for example, if you’re claiming federal low-income housing credits for a property and therefore need to track tenants by class, too.) For example, if you set up a class for Winston Apartments but want to separately track income and expenses related to a certain type of tenant, such as low-income tenants, you could create two subclasses: “Qualified,” for tenants who qualify as low-income tenants, and “Nonqualified,” for tenants who don’t qualify. You might also want to set up subclasses, which are simply classes used to classify the components of a class, for your real estate investments. Setting Up Subclasses for Real Estate Investments Repeat steps 2 through 5 for each real estate property you’ll track as an investment using Quicken. Quicken adds the new class to the list shown in the Class List window. If you need to describe the property in more detail, such as noting the street address, use the Description text box.For example, if you’re setting up a class for a rental property and the property has the name “Winston Apartments,” you might shorten this to “Winston.” Use the Name text box to provide a brief name for the real estate property.Click the New command button to display the Set Up Class dialog box.Choose the Lists → Class command to display the Class List window.To set up classes for your real estate investments, start Quicken and follow these steps: Setting Up Classes for Real Estate Investments Repeat steps 2 through 6 for each income or expense category you’ll use. Quicken adds the new category to the list shown in the Category List window. If you need to describe the category in additional detail, use the optional Description text box.

Use the Income or Expense option button to mark the new category as one that tracks either income or expense.For example, if you’re setting up a category to track a property manager’s expense, you might use the category name “Manager.” Use the Category Name text box to provide a brief name for income or deduction item.Click the Add Category command button to display the Set Up Category dialog box.Choose the Lists → Category List command to display the Category List window.To set up categories for tracking the income and deductions related to your real estate investments, start Quicken and follow these steps:

However, if Quicken doesn’t already have the categories you need, you easily add them. Setting Up Categories for Real Estate Investmentsĭepending on what you told Quicken when you installed it, Quicken may already have the categories you need on its category list. (Note that if you have only a single real estate investment and you know for certain that you’ll never add another real estate investment to your portfolio, you don’t need to set up classes.)īoth tasks are described in the paragraphs that follow.

Quicken rental property manager 2.0 migrate to 2015 software#

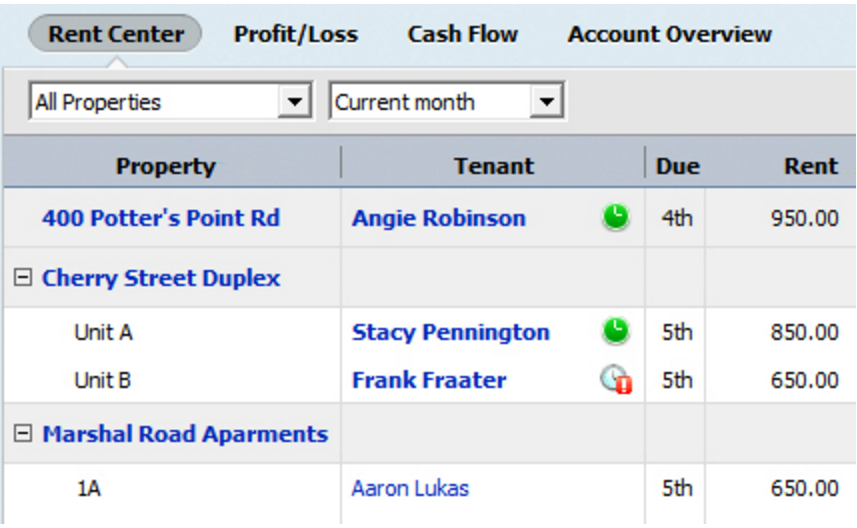

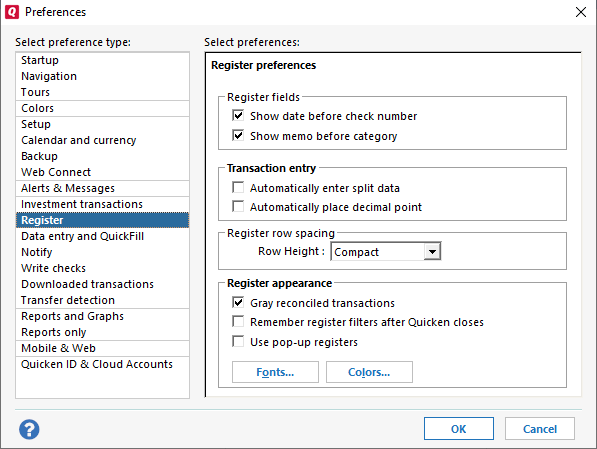

No matter which version of the software you use, Quicken provides a handy format for tracking real estate investments such as income property.īy using the Quicken software for this recordkeeping, you can prepare summaries of income and expenses by property for monitoring your individual real estate investments.

0 kommentar(er)

0 kommentar(er)